Master the Market with AI-Powered Portfolio Management Services (PMS)

AiAlpha offers SEBI-registered Portfolio Management Services designed to help you make smarter investment decisions. Powered by AI and data-driven insights, our PMS solutions are tailored to optimize your portfolio performance, minimize risks, and align with your financial goals. Whether you’re a seasoned investor or just starting out, we help you navigate the market with confidence and clarity.

AI-Driven Portfolio Management Strategies

Unlock smarter investing with AiAlpha’s cutting-edge Portfolio Management Services. Our AI-powered tools and expert-driven strategies help you optimize your portfolio and make informed decisions in dynamic markets.

With AiAlpha PMS, you benefit from:

Technical & Fundamental Stock Selection

Algorithmic & Quantitative Allocation Models

Risk Management & Portfolio Diversification

Behavioral Insights & Smart Rebalancing

Expert-Led Portfolio Management for Smart Wealth Growth

Personalized Investment Strategies Designed to Maximize Returns

Our Portfolio Management Services (PMS) are designed to help investors achieve long-term financial success with a professionally managed, research-driven approach.

No Hidden Fees

Transparent pricing with no surprise charges—just expert portfolio management.

No Minimum Investment Restrictions

Flexible investment options tailored to your financial goals and risk appetite.

Seamless Onboarding Process

A hassle-free setup with expert guidance at every step of your investment journey.

Our Portfolio Management Services

Discretionary Portfolio Management Services

Means the portfolio management services rendered to the Client, by the Portfolio Manager on the terms and conditions contained in this Agreement, where under the Portfolio Manager exercises any degree of discretion in investments or management of assets of the Client.

Non Discretionary Portfolio Management Services

Means the services provided by the Portfolio Manager, who manages the funds in accordance with the discretion of the Client for an agreed fee and invests on behalf of the Client in their account in any type of securities entirely at the Client’s risk and to ensure that all the benefits accrue to the Clients’ Portfolio.

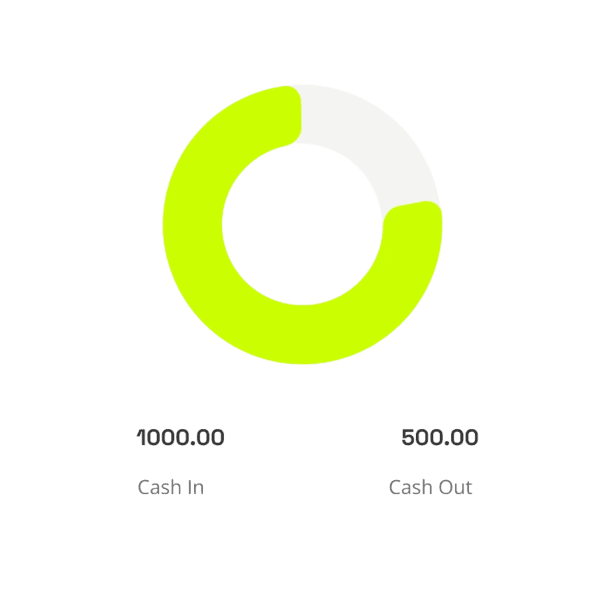

Budgetting

Our Offerings

Personalized Investment Strategy

Custom-built portfolios based on your risk profile, financial goals, and market dynamics.

AI-Powered Decision Making

Leverage advanced algorithms and automation to capture smarter opportunities.

Live Market Monitoring

Real-time analysis and responsive adjustments to optimize performance.

Risk Management & Wealth Building

Develop strategies to protect your capital and maximize long-term returns.